American Airlines on Thursday reported record quarterly earnings of $13.5 billion for the third quarter of 2022.

The Fort Worth-based carrier is also forecasting a better-than-expected fourth-quarter profit, despite economic warning signs, including continued high fuel prices, higher airfares, and a possible recession.

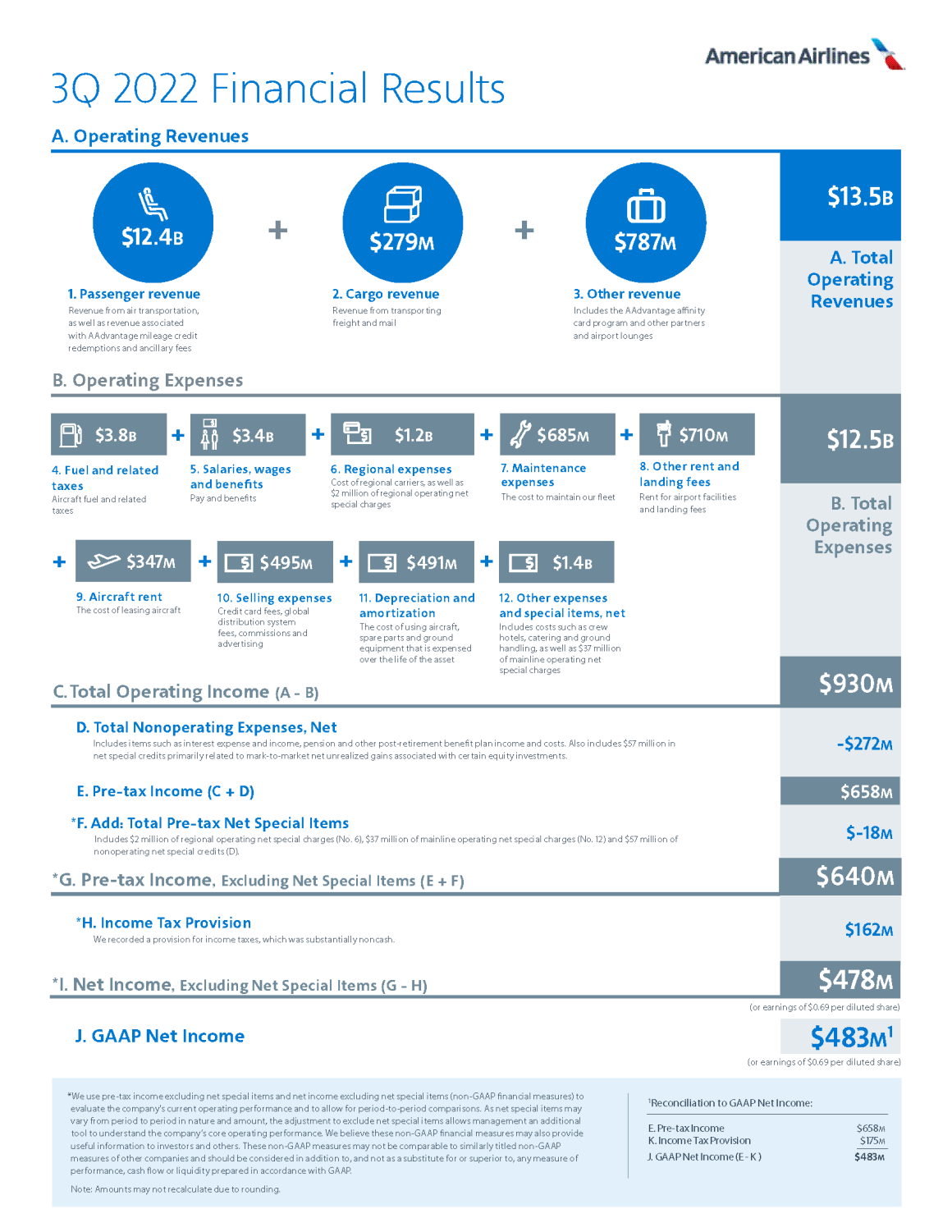

American Airlines Q3 2022 Financial Snapshot

- Third-quarter net income of $483 million, or $0.69 per diluted share. Excluding net special items, third-quarter net income of $478 million, or $0.69 per diluted share.

- Record quarterly revenue of $13.5 billion, representing a 13% increase over the same period in 2019, despite flying 9.6% less capacity.

- Ended the third quarter with $14.3 billion of total available liquidity, more than double the total available liquidity at year-end 2019.

- Company continues to execute on its plan to pay down approximately $15 billion of total debt by the end of 2025.

American Airlines CEO Robert Isom says the airline is well-positioned for the future as air travel continues to rebound from the pandemic.

“The American Airlines team continues to deliver on our goals of running a reliable operation and returning to profitability,” said Isom. “Demand remains strong, and it’s clear that customers in the U.S. and other parts of the world continue to value air travel and the ability to reconnect post-pandemic. American has the youngest, most fuel-efficient fleet among U.S. network carriers, and we are well-positioned for the future because of the incredible efforts of our team.”

Despite Some Challenges, American Airlines Continues its Road to Recovery

Hurricanes in the Caribbean and Florida and flooding in the Dallas-Forth Worth area created operational challenges for the carrier during Q3. Despite this, American operated a schedule over 25 percent larger than its nearest competitor.

With its regional partners, American completed more than half a million flights with an average load factor of 85.3 percent – 6.6 percent higher than Q3 2021.

American reports that its revenue set a quarterly record of $13.5 billion in Q3 2022 – a 13 percent increase compared to 2019. Additionally, American’s Q3 operating margin, excluding net special items, was 7.2 percent.

No Signs of a Slowdown in Demand

American expects consumer demand to continue to increase over the next year. However, continued aircraft delivery delays and a shortage of regional pilots could affect the airline’s growth.

The outlook for long-haul travel is especially positive as countries around the world continue to lift pandemic restrictions.

American expects its fourth-quarter revenue to be 11 to 13 percent higher than Q4 2019 when capacity was nearly seven percent lower. It also expects a Q4 operating margin of between 5.5 and 7.5 percent. Forecast profit per diluted share is between 50 and 70 cents.

Debt reduction also continues to be a key focus for the company. As of 30 September 2022, American’s total debt was $5.6 billion lower than its highest point in 2Q 2021. The company expects to eliminate total debt by $15 billion by the end of 2025.

The company’s shares were down three percent at $13.55.