Is Embraer’s Next-Gen Turboprop program canceled? Not exactly.

Back in August 2022, we ran an article about Embraer’s ambitious plan to reinvent the turboprop.

The Brazilian manufacturer was talking big: a modern regional aircraft that would blend the efficiency of a propeller-driven design with the comfort and speed passengers associate with jets. Letters of intent for more than 250 aircraft rolled in at the Farnborough Air Show, and Embraer projected an entry into service by 2028.

It was an exciting time. The regional jet had dominated headlines for years, but the turboprop—long a workhorse of regional connectivity—suddenly looked like it might have a new lease on life.

Fast forward to the end of 2025, and the picture looks very different. What once seemed like the start of a new chapter for regional aviation has now been shelved indefinitely.

A Program Stalled

In June 2025, Embraer Commercial Aircraft CEO Arjan Meijer told Aviation Week that the turboprop program is “on ice”—and not just lightly chilled. “It is quite far down in the freezer at the moment,” he admitted at the Paris Air Show.

It is quite far down in the freezer at the moment.”

Embraer Commercial Aircraft CEO Arjan Meijer, on the status of Embraer’s Next-Gen Turboprop Program

The reason comes down to technology. The aircraft Embraer envisioned in 2022 promised to be 20% faster and 15% cheaper to operate per seat than current turboprops, while offering a cabin more in line with the company’s E-Jet family. But to achieve those goals, Embraer needed propulsion technology that simply hasn’t materialized.

By the end of 2022, the company had expected to choose between Pratt & Whitney Canada and Rolls-Royce as an engine supplier. That decision never came. In early 2023, Embraer quietly confirmed delays, and by mid-2025, the verdict was clear: without a suitable engine, the program couldn’t move forward.

The Promise Versus the Reality

When we first covered the program, Embraer’s roadmap looked ambitious but achievable. To understand how far things have shifted, it’s worth retracing the program’s journey:

- 2017 — Embraer first proposes the TPNG (Turboprop Next Generation) concept.

- July 2022 (Farnborough Air Show) — More than 250 letters of intent announced.

- August 16, 2022 — Our AvGeekery feature highlights the disruptive potential.

- End of 2022 — Targeted deadline for engine selection.

- Early/Mid-2023 — Planned program launch.

- 2028 — Entry into service for first variant (50- or 90-seat).

- 2029 — Second variant to follow.

- June 2025 (Paris Air Show) — Program officially “on ice.”

By contrast, as 2025’s end approaches quickly, the reality is stark: no engine has been selected, no program launched, and any hope of an entry into service before the 2030s now looks remote.

Embraer’s Shift in Focus

With the turboprop shelved, Embraer has turned its attention back to the jets that have carried its commercial success for the past two decades.

- The E175-E1 is getting avionics and cabin upgrades, such as improved weather radar, larger overhead bins, and mood lighting. These upgrades are designed to keep it competitive in the US regional market, where scope clauses still restrict the use of heavier E2 variants.

- The E190-E2 and E195-E2 continue to anchor Embraer’s commercial lineup. They benefit from cockpit commonality with the E175-E1 and appeal to airlines seeking efficient sub-150-seat jets.

- Future possibilities, such as E195-E1 freighter conversions, are being discussed but not yet formalized.

Meijer has been clear: Embraer isn’t walking away from regional aviation. It’s just choosing to invest in incremental improvements to its jets rather than roll the dice on an all-new turboprop.

The Market That Got Away—for Now

The irony is that Embraer was targeting a genuine gap in the market. Since the pandemic, smaller US cities have lost air service as 50-seat jets disappeared from fleets. As Meijer noted this year: “I definitely see a demand in the US for between smaller cities since that segment is shrinking.”

I definitely see a demand in the US for between smaller cities, since that segment is shrinking.

Embraer Commercial Aircraft CEO Arjan Meijer

But who will step up to meet that demand?

- Boeing and Airbus have no plans to reenter the turboprop market. The Airbus A220 is a strong performer, but too large for many smaller communities.

- ATR is sticking with incremental updates to the ATR 42 and 72, opting against a clean-sheet design.

- Bombardier and de Havilland are out of the commercial turboprop game.

- Mitsubishi canceled its SpaceJet.

- China and Russia are unlikely to make inroads in Western markets anytime soon.

That leaves Embraer. And yet, for now, Embraer is content to sit it out.

Forecasts Reset

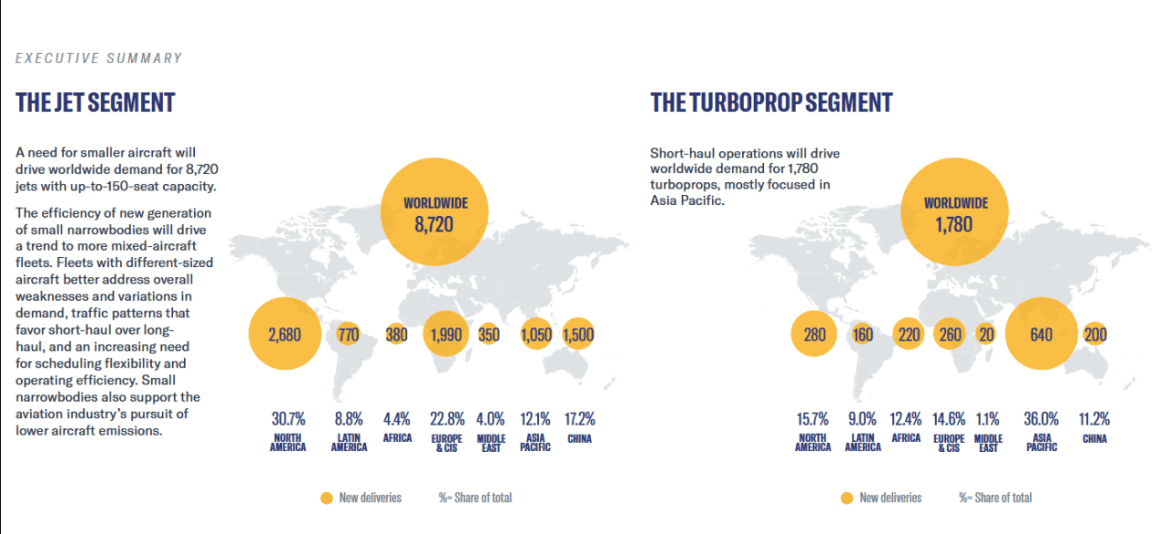

Embraer’s own 2025 Market Outlook reflects this retrenchment. The company now projects global demand for about 10,500 sub-150-seat aircraft through 2044, of which only 1,780 are expected to be turboprops. That’s a marked drop from earlier forecasts of more than 2,100.

The reasons are clear: engine technology isn’t ready, certification risks are high, and airlines in North America and Europe are leaning more toward regional jets than turboprops.

Still, in markets like Asia-Pacific and emerging economies, the economics of turboprops remain attractive. The demand hasn’t disappeared—it’s just waiting for the right aircraft to capture it.

Embraer’s Next-Gen Turboprop Remains Disruptive, But Not for the Right Reason

When we first covered Embraer’s next-gen turboprop in 2022, it was billed as a program that could redefine regional aviation. The numbers looked strong, the interest was genuine, and the momentum was building.

Three years later, the narrative has shifted dramatically. The turboprop program isn’t dead, but it’s “quite far down in the freezer,” as Arjan Meijer put it. The gap in the market is still there, the demand is still real, but the aircraft that was supposed to meet it remains frozen in development limbo.

For now, Embraer is focused on what it already does best: refining the E-Jet family and extending its commercial success in the sub-150-seat jet market. Whether the company eventually returns to turboprops will depend not just on Embraer’s ambition, but on whether propulsion technology can catch up with its vision.

And so, Embraer’s next-gen turboprop remains exactly what we called it in our first article: disruptive. Only this time, the disruption is the absence of progress, leaving a hole in the regional market that no one else seems ready to fill.