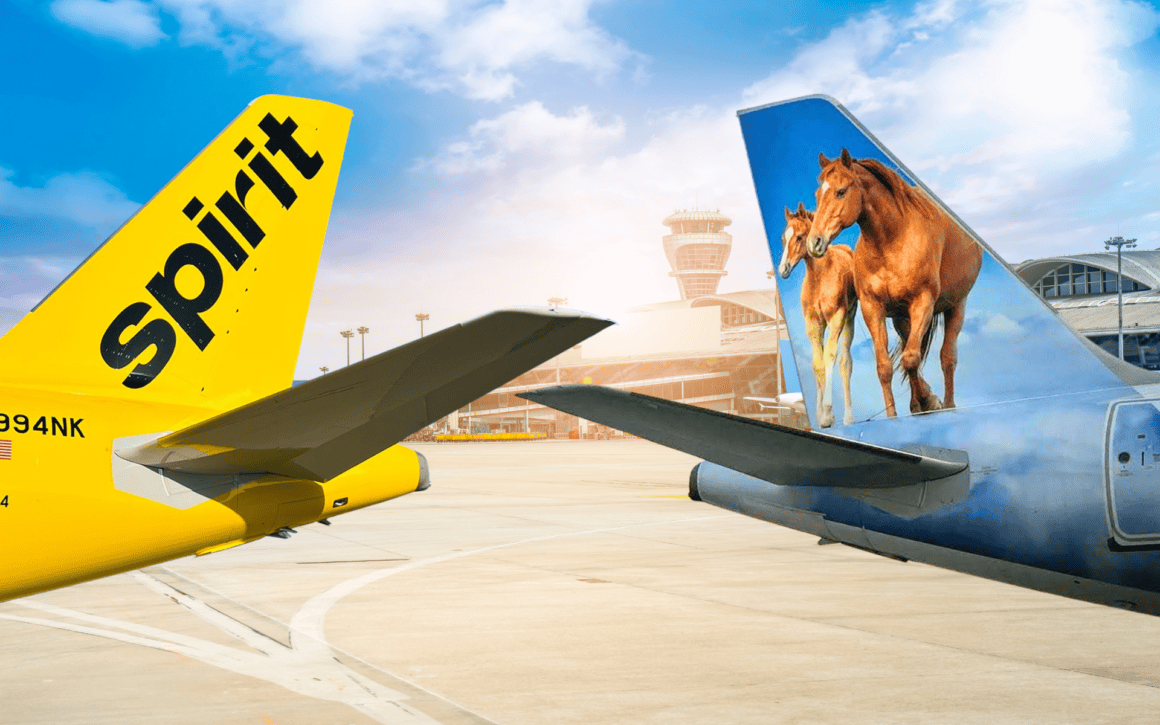

With fresh cash, new leadership, and familiar talks resurfacing, Spirit and Frontier may be circling each other once again.

If this is starting to feel familiar, you’re not imagining it.

According to a Bloomberg report on Tuesday, Spirit Airlines and Frontier Airlines are once again exploring a potential merger. Yes, again. And yes, for what feels like the fourth time in just a few years.

What makes this round different isn’t just the talks themselves, but when they’re happening.

A Very Interesting Week for Two Very Familiar Rivals

The timing here is hard to miss.

Just days ago, bankrupt Spirit Airlines secured a critical $100 million financial lifeline to keep operating under Chapter 11 protection. That funding came with strings attached. Specifically, Spirit agreed to seriously consider a “strategic transaction,” which in plain English means selling itself or merging with someone else.

Then, almost immediately after that news broke, Bloomberg reported that Spirit Aviation Holdings is in active discussions with Frontier Group Holdings about combining the two ultra-low-cost carriers.

At the same time, Frontier is entering a new chapter of its own. On Monday, the airline announced the abrupt exit of longtime CEO Barry Biffle, handing the reins to company insider James Dempsey on an interim basis.

New leadership. Fresh financial pressure. Old merger talks back on the table.

It’s a lot to happen in a very short window.

This Story Has Been Playing on Repeat Since 2022

Spirit and Frontier have been circling each other for years.

The two carriers first announced plans to merge in 2022, only to see that deal derailed when JetBlue swooped in with a higher offer. That takeover ultimately collapsed after the Department of Justice successfully blocked it in court.

Since then, Frontier has made multiple attempts to bring Spirit back to the table.

In early 2024, Frontier proposed a deal valued at roughly $580 million, offering Spirit shareholders a minority stake in the combined airline. That effort fizzled. A later unsolicited offer earlier this year, valued even lower, was also rejected.

Spirit argued each time that Frontier’s bids undervalued the airline and lacked sufficient certainty to close. Frontier, for its part, walked away more than once.

Now, with Spirit back in Chapter 11 for the second time in less than a year, the balance of power looks very different.

Spirit’s Options Are Narrowing Fast

Spirit entered its latest bankruptcy in August with the stated goal of restructuring and emerging as a standalone airline. Since then, it has aggressively cut costs, reduced flying, exited 14 airports, and shed commitments tied to more than 80 aircraft leases.

Even with those moves, cash has remained tight.

Over the weekend, Spirit narrowly met the conditions required to unlock additional debtor-in-possession financing. Lenders ultimately agreed to amend the terms, allowing Spirit access to $100 million in emergency funding to keep the lights on while it reassesses its future.

MORE SPIRIT AIRLINES COVERAGE ON AVGEEKERY

- Spirit Airlines’ Future in Jeopardy After Stunning Going-Concern Disclosure

- Spirit Airlines Is Quitting These 11 Cities — Is Yours on the List?

- Spirit Airlines Files for Bankruptcy Again: The ULCC Restructures for Survival

- Judge Approves Sale of 23 Spirit Airbus Aircraft for $519 Million

- Spirit Airlines Files for Bankruptcy Amid Rising Financial Pressures

Industry executives and analysts have long viewed a merger with Frontier as Spirit’s most viable path forward. In October, Spirit itself acknowledged it was evaluating all strategic options, including a sale or merger, to maximize shareholder value.

That evaluation now appears to be very real.

Frontier’s Side of the Equation Is Changing Too

Frontier hasn’t exactly been thriving either.

Ultra-low-cost carriers are facing higher operating costs, softer demand at the bottom end of the market, and intense competition from legacy airlines that can match fares, add capacity, and lean on powerful loyalty programs.

Frontier has struggled in that environment, posting significant losses this year and seeing its stock slide sharply. Under former CEO Barry Biffle, the airline was reportedly cautious about absorbing Spirit, concerned that taking on a bankrupt rival could strain its balance sheet.

With Biffle now out and James Dempsey stepping in, that caution may be getting reassessed.

What’s Next for Spirit and Frontier?

Bloomberg reports that a deal could be announced as soon as this month, though talks are ongoing and could still fall apart. Both Spirit and Frontier declined to comment publicly.

That uncertainty feels familiar, too.

But this time, Spirit may not have the luxury of walking away. The airline’s lenders have made it clear that additional funding depends on exploring a strategic transaction. Remaining independent is looking less and less realistic by the day.

So here we are again.

Same two airlines. Same basic idea. Very different circumstances.

Will this finally be the time it sticks, or is this just another chapter in aviation’s longest-running merger saga?

At this point, it might be Spirit’s last real shot.