Transaction will create the 5th largest airline in the United States.

While you were sleeping, the United States commercial airlines business grew a fifth major carrier.

In a deal announced in the middle of the night, Alaska Airlines has acquired Virginia America for $2.6 billion in cash. It’s yet another example of the consolidation of air carriers in the U.S. JetBlue also was showing interest but couldn’t match Alaska Airlines’ deal. The purchase moves Alaska Airlines pass JetBlue into fifth place behind American, United, Southwest and Delta airlines.

The merger is expected to be completed by the beginning of next year. A potential roadblock could be government regulators concerned over yet another airline merger. The Justice Department sued to block American Airlines’ acquisition of US Airways in 2013, but after negotiations decided to drop the legal action.

“Our employees have worked hard to earn the deep loyalty of customers in the Pacific Northwest and Alaska, while the Virgin America team has done the same in California. Together we will continue to deliver what customers tell us they want: low fares, unmatched reliability and outstanding customer service,” said Brad Tilden, chairman and CEO of Alaska Air Group. “With our expanded network and strong presence in California, we’ll offer customers more attractive flight options for nonstop travel. We look forward to bringing together two incredible groups of employees to build on the successes they have achieved as standalone companies to make us an even stronger competitor nationally.”

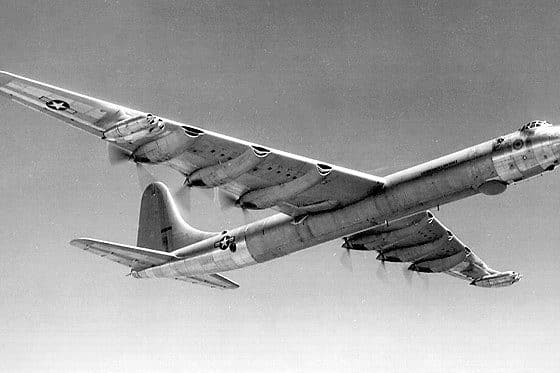

In addition to adding Virginia America’s routes and gates, Alaska Airlines will be adding to its fleet with Virgin America’s 60 Airbus A320 jets. Similar to Southwest Airlines, Alaska Airlines has “kept it simple” by flying one aircraft; it operates a fleet of 147 Boeing 737s.

Virginia America, which was founded in 2007, went public 18 months ago. After nearly a decade of operating at a deficit, Virginia made money in 2015. A “boutique airline” owned by British billionaire Richard Branson, its value was more in its planes and its routes than in its business plan. When the news broke that it was for sale, it was first thought that Delta or JetBlue would be the major possibilities as buyers.

If the merger goes through, it will be interesting to see if Alaska Airlines keeps some of the unique service – live TV, mood lighting, spacious seating – that has made Virgin Airlines a “hip” trip experience.

The acquisition will allow Alaska Airlines, which is based in Seattle, to become perhaps the dominant carrier on the West Coast. Alaska already has a strong base in the Northwest and the state of Alaska but will now have a competitive presence in California, particularly in Los Angeles and San Francisco.

“We will be the airline of the West Coast,” Tilden said.