With the world’s two dominant OEMs booked up through the end of the decade, is there room for a new competitor?

As the demand for commercial jetliners continues to jam up assembly lines at Boeing and Airbus, a new competitor threatens to break up the duopoly.

The Commercial Aircraft Corporation of China, or COMAC, represents a bold initiative by the Chinese government to establish a competitive presence in the global aerospace market. Founded in 2008, the Shanghai-based manufacturer aims to reduce China’s reliance on Western aircraft manufacturers.

Although still in its infancy, COMAC has made significant strides through its ambitious aircraft programs, including the ARJ21, C919, and the upcoming C929 and C939. Each of these projects underscores China’s determination to become a leading player in the global aerospace industry.

But just how much of a threat is COMAC?

The short answer is not much—at least for now. At present, COMAC has a relatively modest presence in the skies of China with minimal exposure elsewhere. Two of its products, the ARJ21 regional jet and the C919 short- to medium-range airliner, are currently being produced at a snail’s pace. Two widebody products – the C929 and C939 – are in the design phase.

The ARJ21: The Chinese Regional Jet

The ARJ21 marks COMAC’s initial foray into the commercial aircraft market. The ARJ21 (ARJ stands for “Advanced Regional Jet”) serves short-range routes, seating between 70 to 105 passengers in a 2-3 configuration. The development of this twin-engine, single-aisle jet began in 2002, aiming to compete directly with established regional jets like the Bombardier CRJ and Embraer E-Jets.

The type’s journey from concept to commercial service was fraught with challenges. Originally, COMAC planned for the maiden flight in 2005 and commercial service by mid-2006. However, the program experienced significant delays, with the prototype unveiled only in 2007 and the maiden flight occurring on 28 November 2008. These setbacks, primarily due to design and certification issues, postponed the aircraft’s entry into service until 28 June 2016, when Chengdu Airlines operated the first revenue flight.

Questioning the Originality of the ARJ21

The ARJ21 features wings designed by Antonov and is powered by two General Electric CF34 engines mounted at the rear. The aircraft’s design, which some critics liken to the CRJ or the Boeing 717, is claimed by COMAC to be entirely original. The ARJ21-700 is the standard model, with a seating capacity of 70-95 passengers, while the ARJ21-900, a stretched variant similar to the Bombardier CRJ900 or Embraer 175-E2, will accommodate 95-105 passengers. Additional variants include freighter and executive versions, dubbed the ARJ21F and ARJ21B, respectively.

Certified in January 2023, the ARJ21CCF (Comac Converted Freighter) boasts a maximum payload capacity of 22,377 pounds and a range of 1,726 miles. Chengdu Airlines took delivery of the first two converted freighters in October 2023.

The ARJ21B is expected to seat 20 passengers in a one-class configuration.

International Reach and Future Prospects

While the ARJ21 predominantly serves domestic routes within mainland China, Indonesian airline TransNusa became the first international customer of the type in 2022. The carrier currently operates two ARJ21-700s with an additional 28 on order.

Brunei’s Gallop Air placed an order for 15 ARJ21s in September 2023. There are also reports that the Republic of Congo’s national carrier, ECAir, is considering acquiring three ARJ21s.

Today, 146 ARJ21 airframes are operating, with more coming online slowly but steadily. The type also recently carried its ten millionth passenger.

The C919: China’s Challenger to the A320 and 737 MAX

The C919 represents COMAC’s most significant effort to date in challenging the Airbus-Boeing duopoly in the single-aisle jet market. Designed to accommodate 150-190 passengers, it targets short- to medium-range routes, directly competing with the more efficient Airbus A320neo and Boeing 737 MAX families.

The development of the C919 began in 2008, with the first flight taking place on 5 May 2017. After extensive testing and certification processes, launch customer China Eastern Airlines took delivery of the first C919 on 28 May 2023.

COMAC Will Produce Shortened and Stretched Variants of the C919

Powered by two CFM International LEAP (Leading Edge Aviation Propulsion) engines, the C919 shares many design characteristics with the Airbus A320, including similar wingspan and fuselage dimensions. COMAC is developing shortened and stretched variants of the C919 to enhance its market appeal, with capacities ranging from 130 to 240 passengers and a maximum range of 3,500 miles.

The shortened variant will focus on high-altitude destinations within 2,500 miles, while the extended variant will have a range of up to 3,500 miles.

C919 Production and Market Reception

With over 1,500 orders for the C919 on the books, reception to the type has been far more robust than that of the ARJ21. Production is progressing slowly, however, with COMAC aiming to achieve an annual output of 150 aircraft by 2028. Notable international orders include US-based aircraft lessor GE Capital Aviation Services and AerCap, an Irish aviation leasing company. Tibet Airlines has ordered 40 shortened-variant C919s to operate in the Himalayan Plateau region. Air China and China Southern have also ordered 100 C919s each.

China Eastern is currently the sole operator of the type, with six C919-100s in service and an additional 100 on order. The airline anticipates having ten C919s in its fleet by the end of 2024.

Despite the slow start, the future of the C919 looks promising – at least domestically – as COMAC works to ramp up production.

Chinese officials hope to receive European approval sometime in 2025, which would allow for expanded international operations. However, industry experts say that is unlikely.

The C929: A Long-Range Vision

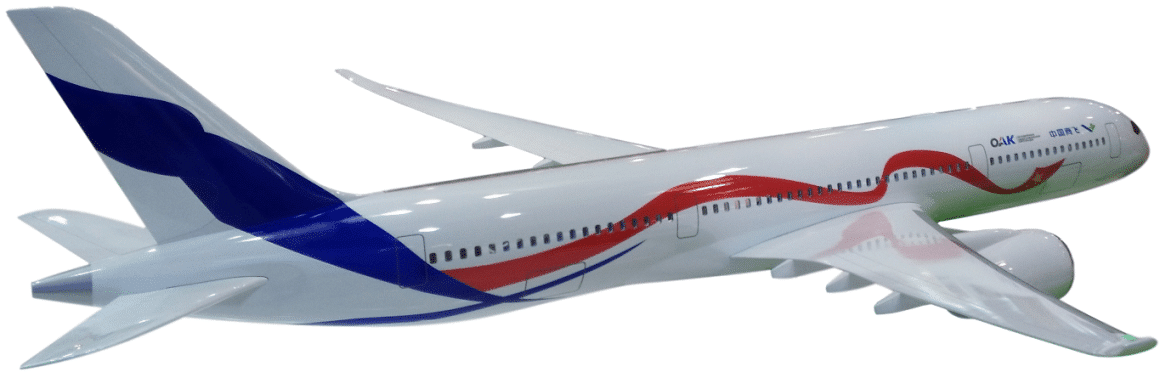

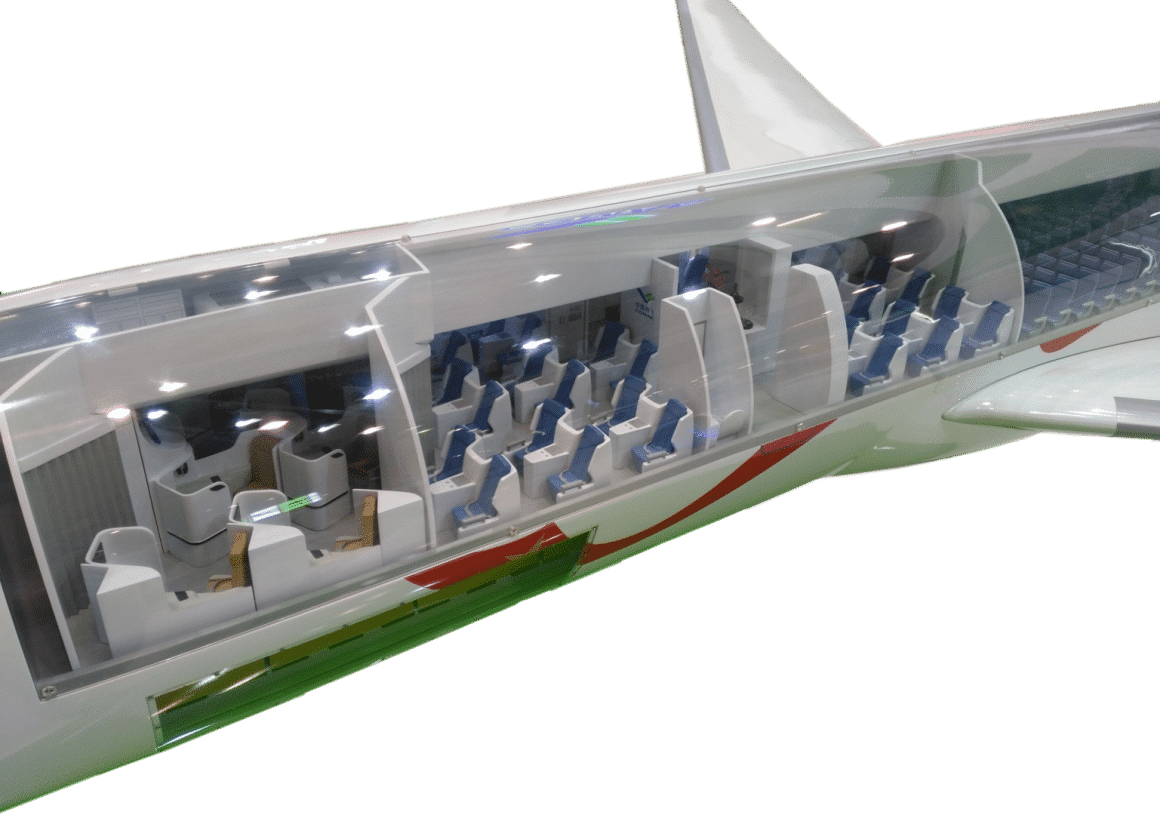

The C929 is COMAC’s ambitious project to penetrate the long-range widebody market, competing with the Airbus A330 and Boeing 787.

At its onset, the project was a joint Chinese-Russian venture to replace the Ilyushin Il-96 under the banner of the China-Russia Commercial Aircraft International Corporation (CRAIC). Dubbed the CRAIC CR (China-Russia) 929, its maiden flight was slated to occur between 2025 and 2028. However, the project faced setbacks due to geopolitical tensions and sanctions following Russia’s invasion of Ukraine in 2022.

In 2023, COMAC announced it would continue the venture independently, thus renaming the project C929.

Design, Development, and Future Prospects for the C929

Currently in the detailed design phase, the C929 is planned to offer three variants with varying capacities and ranges. The -500 variant will seat 250 passengers and feature a range of 8,700 miles, while the -600 and -700 variants will accommodate 280 and 320 passengers and feature a range of 7,500 and 6,200 miles, respectively. An all-economy configuration could potentially seat up to 440 passengers.

By comparison, the Airbus A350 has a range of 9,600 miles, while the Boeing 787-8 has a range of 8,500 miles.

Any final specifications are subject to the final design and materials.

The final choice for the C929 powerplants is yet to be determined, but initial production will likely have to rely on engines from Western manufacturers like Rolls-Royce or General Electric. Despite the breakdown of the China-Russia venture, COMAC aims to deliver the first fuselage by September 2027, though test flights are unlikely before 2030.

The C939: Just Announced

The C929 evidently won’t be the only widebody jetliner produced by COMAC.

Earlier this month, Chinese media reported that COMAC had begun preliminary design work on the C939, another twin-aisle widebody jet.

The type, which will compete with the Boeing 777 (including the 777X) and Airbus A350, will reportedly feature a capacity of up to 400 passengers.

While not much else is public knowledge at the moment, the C939 signifies COMAC’s intent to challenge the dominance of the world’s leading OEMs in the long-haul segment.

The Road Ahead: Challenges and Opportunities

However, this is still years – perhaps more than a decade – down the road. And much can happen between now and then. So, for now, the Airbus-Boeing duopoly is safe. But it’s hard to imagine what the world could look like a decade from now. If the last decade has taught us anything, so much can change so quickly.

COMAC’s journey from the ARJ21 to the C939 illustrates China’s growing capabilities and ambitions in aerospace manufacturing. However, becoming a global aerospace player is a long road. COMAC’s production capacity remains severely limited, and significant efforts are needed to scale up to meet demand.

The company aims to produce 150 aircraft annually by 2028, but reaching Airbus and Boeing’s production efficiency and technical support levels by 2035 will require substantial advancements.

The global aerospace industry is rapidly evolving, with China poised to surpass the United States as the world’s largest aviation market in the next few years. This shift presents both opportunities and challenges for COMAC. While the company benefits from robust domestic demand, gaining a foothold internationally will require overcoming technical, regulatory, and geopolitical hurdles.