US Secretary of War Pete Hegseth’s Boeing C-32A was forced to declare an in-flight emergency on Wednesday afternoon, 15 October.

The flight safely diverted to RAF Mildenhall in England after the crew discovered a crack in the cockpit windshield, officials confirmed.

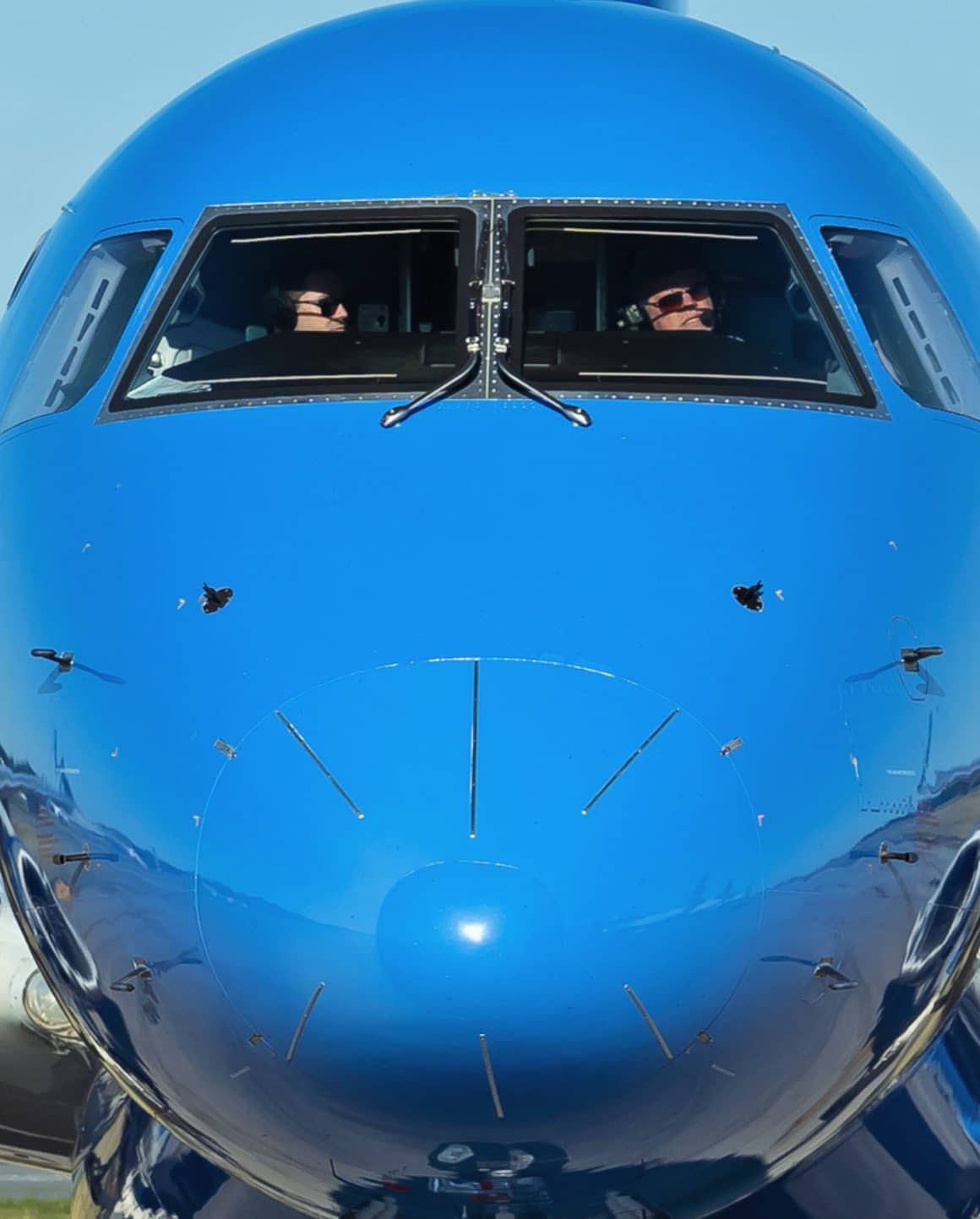

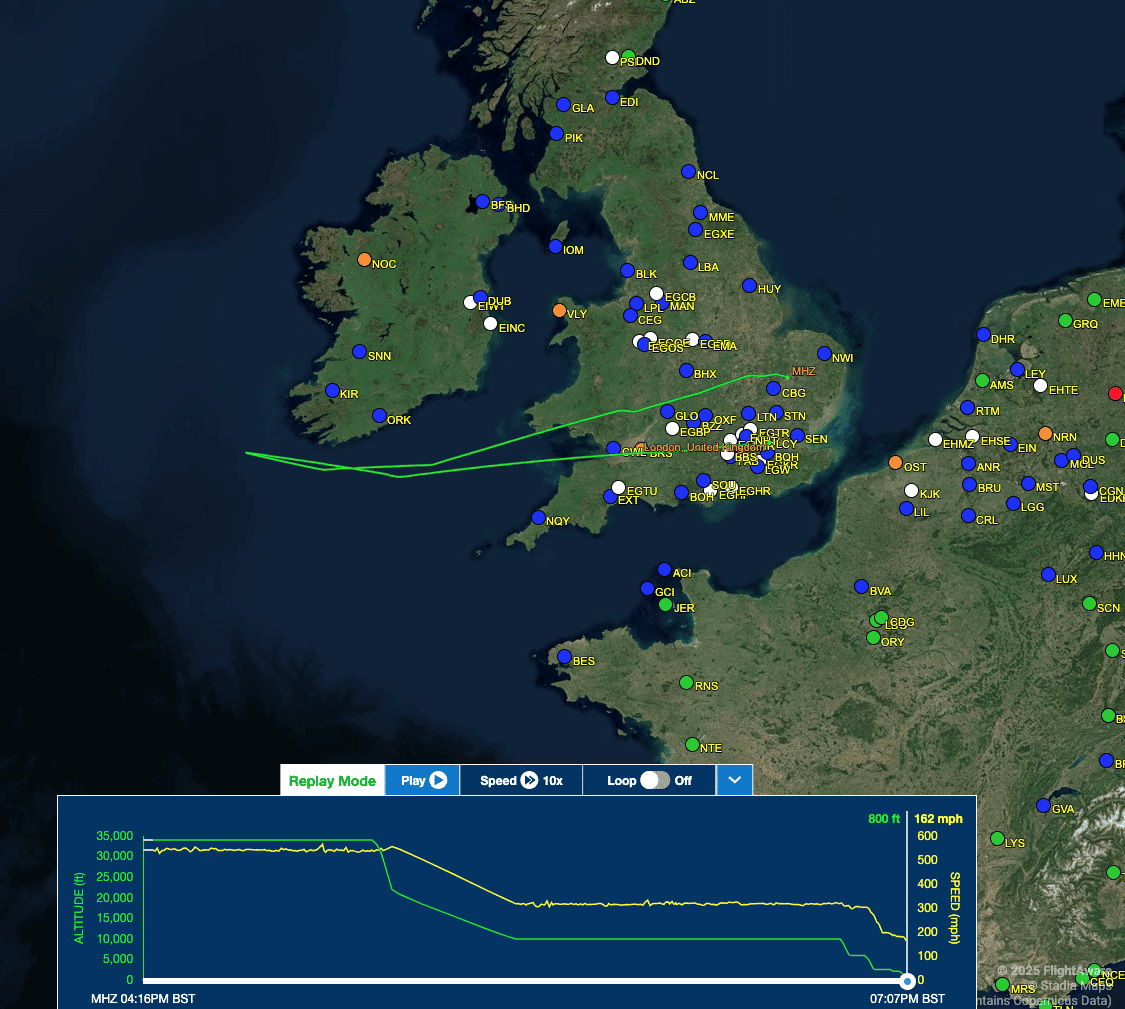

The Boeing C-32A, a military version of the Boeing 757 used to transport senior US government and military officials, had departed Brussels bound for Washington, D.C., following Hegseth’s attendance at NATO defense minister meetings. About thirty minutes into the transatlantic leg, as the jet cruised over the Atlantic near southern Ireland, the flight crew identified a growing fracture across one of the forward cockpit panes–a relatively uncommon, but not unprecedented, issue.

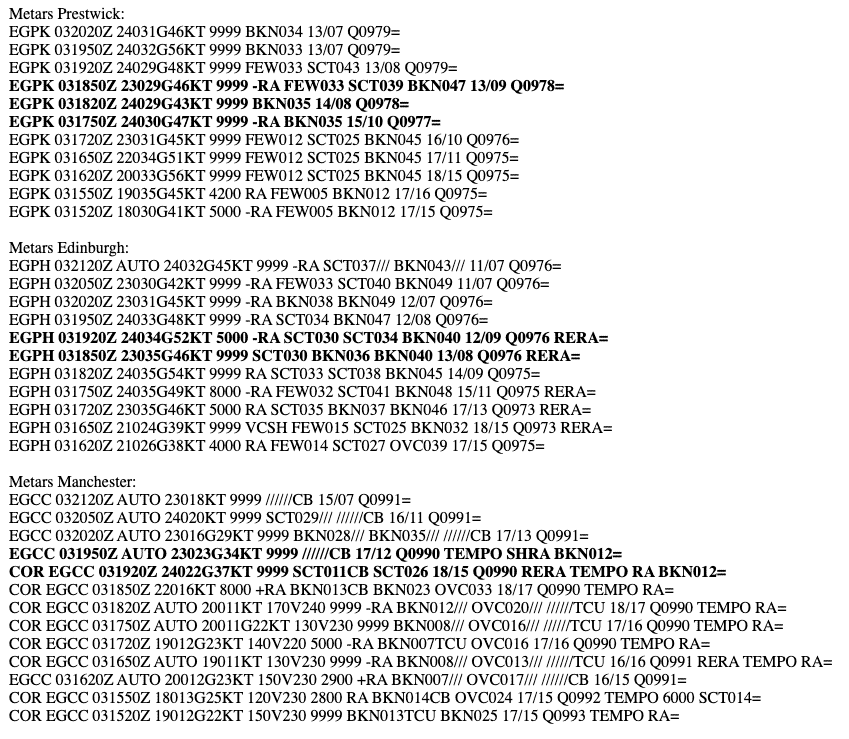

Following protocol, the pilots squawked 7700, indicating a general emergency, and began a descent to 10,000 feet, the altitude where the aircraft can safely operate in the event of cabin depressurization. With Mildenhall’s long runways and nearby US Air Force facilities, officials decided to divert.

At approximately 1908 local time, the aircraft, operating under the callsign SAM153, made a safe landing on Runway 10 at RAF Mildenhall, where emergency crews were positioned on standby. No injuries were reported.

“On the way back to the United States from NATO’s Defense Ministers meeting, Secretary of War Hegseth’s plane made an unscheduled landing in the United Kingdom due to a crack in the aircraft windshield,” Pentagon spokesperson Sean Parnell said in a statement on X. “The plane landed based on standard procedures, and everyone onboard, including Secretary Hegseth, is safe.”

Moments later, Hegseth posted on X:

“All good. Thank God. Continue mission!”

The aircraft was shadowed by a KC-135T Stratotanker, which had been accompanying the C-32A, possibly for communications or fuel support. According to flight-tracking data, the two aircraft remained in close formation throughout the descent and approach into Mildenhall.

The C-32A is now grounded for inspection while US Air Force maintenance crews assess the extent of the windshield damage and surrounding structure. A full safety investigation is expected.

While windshield cracks are, thankfully, relatively rare, they are by no means unprecedented. Similar incidents have occurred on commercial and military 757s, often linked to thermal stress or faults in the windshield’s electrical heating system. In February, a C-32 carrying Secretary of State Marco Rubio turned back to Joint Base Andrews after a cockpit window issue.

Windshield cracks on aircraft very rarely lead to actual emergencies, but they can happen.

For now, Hegseth is expected to continue his return to Washington aboard an alternate aircraft once technical inspections wrap up. The outcome, though tense, seems to have been handled exactly as it should have been: calm, by the book, and without drama.

It’s the second high-profile in-flight issue involving U.S. government aircraft in recent weeks. In September, Marine One, carrying President and Mrs. Trump, made a precautionary landing in England after a hydraulic warning light triggered mid-flight.

Inside the C-32A: America’s VIP Workhorse

The C-32A provides safe, comfortable, and reliable global transportation for US leaders — primarily the Vice President, who uses the call sign “Air Force Two” when aboard, as well as the First Lady and members of the Cabinet and Congress. Operated by the 89th Airlift Wing at Joint Base Andrews, it forms part of the Air Force’s Special Air Mission fleet, tasked with carrying the nation’s highest-ranking officials anywhere in the world.

Derived from the Boeing 757-200, the C-32A shares the same airframe as the commercial jetliner but features a completely reconfigured interior and advanced 21st-century avionics. Inside, the cabin is divided into four sections:

- Forward Area: Communications center, galley, lavatory, and ten business-class seats.

- Executive Stateroom: A private suite for the primary passenger, complete with a changing area, lavatory, entertainment system, two first-class swivel chairs, and a divan that converts into a bed.

- Conference and Staff Area: Equipped with eight business-class seats for meetings and mission coordination.

- Aft Cabin: General seating with thirty-two business-class seats, a galley, two lavatories, and storage closets.

Because the aircraft sits relatively high off the ground, security personnel have clear sightlines under and around the fuselage. This feature is a subtle but important advantage for protecting dignitaries on the ramp.

In the cockpit, state-of-the-art avionics include a traffic collision avoidance system (TCAS), enhanced ground proximity warning, predictive wind shear detection, and a future air navigation system integrating GPS and digital flight management. The C-32 also features extensive communications capabilities, including satellite telephony, secure data links, fax and printing systems, and real-time video connectivity, which enable decision-makers to conduct business seamlessly in flight.

Powered by two Pratt & Whitney PW2040 engines, each producing 41,700 pounds of thrust, the C-32 can fly 5,500 nautical miles unrefueled, cruise at 537 mph, and operate from runways as short as 5,000 feet. Compared with its predecessor, the C-137 Stratoliner, the C-32 is twice as fuel-efficient and offers a far greater operational range.

The Air Force awarded Boeing the contract for the C-32 in August 1996, and the first aircraft entered service less than two years later, a record for a major military acquisition program. Only four are currently active, all flown by the 1st Airlift Squadron at Andrews.